High costs of drugs are not tightly correlated with value, and pricing decisions by many manufacturers are responsible for high costs, patient burden, and unsustainable pharmaceutical markets.

Read the full article at: https://ascopubs.org/doi/10.1200/OP.23.00579

Pramod John, CEO of VIVIO Health, discusses issues with drug pricing and competition in the pharmaceutical industry. He talks about how the current system incentivizes higher spending on healthcare rather than better outcomes, and how lack of transparency and access to data prevents true competition.

[00:00:15] Introduces VIVIO Health mission[00:02:07] Background and improving healthcare

[00:05:40] US overspends on drugs

[00:08:39] Public benefit corporation

[00:12:11] Rebates misalign incentives

[00:17:29] FDA approves ineffective drugs

[00:24:15] FDA efficacy vs. effectiveness

[00:29:47] Health insurance exchanges

[00:33:03] Humira lacks competition

[00:40:51] Lower cost Humira biosimilars

[00:44:38] Employers overpay despite alternatives

[00:47:53] Consultants have misaligned incentives

[00:51:46] Importance of fiduciary duty

[00:53:39] Data access drives competition

[00:55:33] Similar issues in other industries

[00:57:31] Ask doctors for data on treatments

Listen to the full podcast at: https://www.bizofpharmpod.com/exposing-the-hidden-costs-behind-prescriptions-pramod-john-vivio-health/

VIVIO CEO, Pramod John, speaks with UK-based Consilium Scientific.

The paradox: Why can’t we reject high costs and subpar drug quality? Delve into healthcare inefficiencies driving this disparity and explore a pragmatic path to enhance outcomes and cut costs! Why can’t we say ‘No’ to high prices and low drug quality? The United States, which accounts for only 4% of the world’s population, spends as much on drugs as the rest of the world combined. Despite this, health outcomes in the US are often worse than those in developing countries. Economic inefficiencies of the healthcare system are the main drivers of these poor results. By focusing on outcomes and taking a commonsense approach, significant cost savings can be achieved.

I informed him of the vast price difference and asked which he would prefer. This veteran did not hesitate for a second: “I will take the cheap one, doc…. I am not the only one in this foxhole.” This sentence broke my heart, and, to this day, its recall gives me goose flesh and unavoidable flowing tears. This intense and unforgettable experience, although long ago and far away, remains highly relevant to today’s cancer medicine.

Read the full article at: https://ascopost.com/issues/september-10-2023/perspectives-on-cancer-therapy-development The Food and Drug Administration (FDA) approves about two thirds of new cancer drugs on the basis of clinical trials that use surrogate end points, such as laboratory values or radiographic findings, rather than clinical end points that assess survival or how patients feel or function. The accelerated approval program allows drugs designed to treat serious conditions for which there is an unmet medical need to be approved on the basis of changes in surrogate measures that are only reasonably expected to predict clinical outcomes. Because in certain fields of medicine, such as cancer, a drug’s effects on surrogate measures such as tumor size (see table) are often more pronounced and occur more rapidly than effects on a patient’s clinical status, trials focused on surrogate measures can enroll fewer patients and can be completed more quickly than trials with clinical end points, thereby enabling products to reach the market earlier. Since clinical end points such as survival are generally what matter to patients, however, the FDA requires that the clinical benefits of drugs granted accelerated approval be confirmed in subsequent trials.

Read the full article at: https://www.nejm.org/doi/full/10.1056/NEJMp2306872/Mark Cuban Cost Plus Drug Co. is most known for selling cheap prescription drugs directly to consumers through the mail, but those cheap prices have been turned into a benefits solution for health plans … The company previously partnered with three PBMs: Rightway, EmsanaRx and RxPreferred Benefits. In October, Cost Plus Drugs began collaborating with VIVIO, a specialty drug management platform that works with health plans and self-insured employers.

Read the full article at: https://www.beckerspayer.com/payer/how-mark-cubans-cost-plus-drugs-has-been-turned-into-a-health-plan-benefit.htmlHumira biosimilars have given employers and policy makers a false sense of security about impending cost relief, but all that’s happened is the health industry has once again succeeded in making us lose sight of the real problem. The unanswered question is how and why Humira became the biggest selling drug in history. If we don’t reflect on the root cause of our drug problem, we’re going to have the same hand wringing conversation five or 10 years from now, with a different set of drug names.

The root cause: an anti-competitive PBM model

In a free and fair market, the drug with the best outcomes data for each patient at the best price would win. Humira has been on the market for so long that its patents have expired and biosimilars have been available to 96% of the world’s population outside of the U.S. for years. Humira is not the best at anything; it is just one of many inflammatory drugs with average clinical data. As proven in clinical trials, different drugs work for different people. For instance, in rheumatoid arthritis (RA) trials, only 10% of those taking Humira achieved a great response (ACR 70 score), while 76% achieved a mediocre to no response. Fewer than 25% of patients receive a good response from the best-selling drug of all time.Read the full article at: https://www.benefitspro.com/2023/05/04/why-biosimilars-will-fail-and-what-we-can-do-about-it/

“It’s the law unintended consequences,” Pramod John, Ph.D., chief executive officer of Vivio Health. “The ACA’s intent was not that providers now can charge whatever they wanted for service, whether a drug manufacturer or hospital. It was trying to protect a member could have a million dollar out of pocket costs in a year. This is when we started to see expansion of drug pricing because now with out-of-pockets limits, it doesn’t matter whether a drug costs $6,000 or $600,000.”

Pharmaceutical manufacturers, John said, started offering copay cards after high-deductible plans were launched. “Now a drug manufacturer can arbitrarily raise the price of a drug or remove all pricing sensitivity for the cost of the drug by paying patients’ copays and deductibles.”

Ultimately, it’s a steering mechanism, he said. “Copay cards set up economic incentives that favor the wrong behavior,” John said. “We’ve removed pricing sensitivity for patients and incentivized providers to be able to jack up the price of goods and services.”

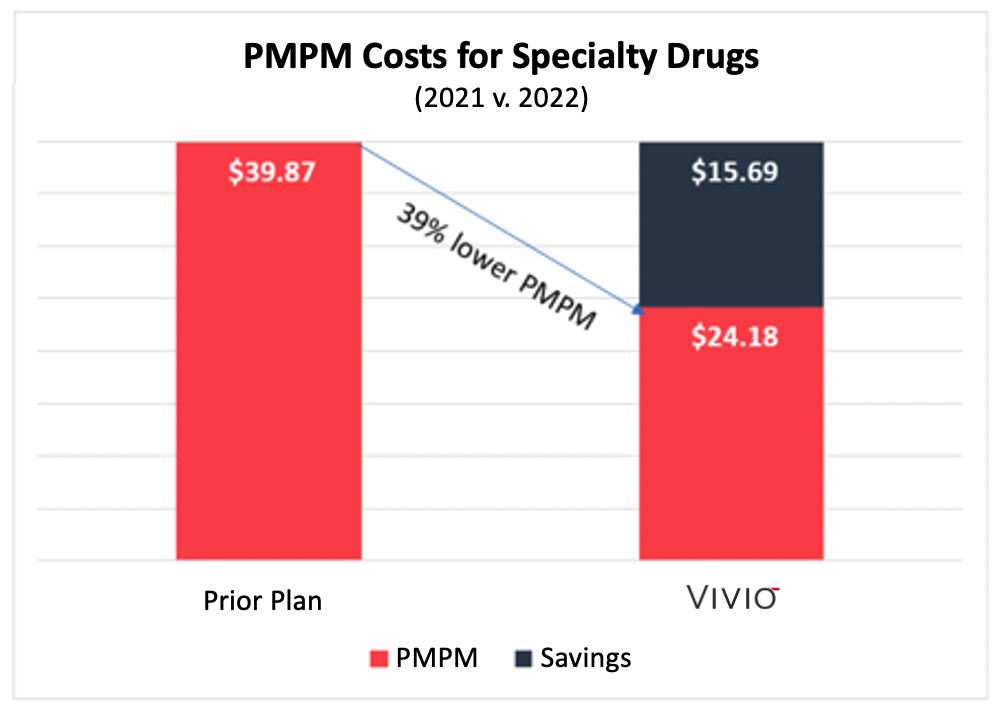

Read the full article at: https://www.formularywatch.com/view/patients-often-lose-in-the-battle-between-pharma-and-pbmsSan Leandro, CA – VIVIO, the leading drug outcomes company, proudly announces third-party validation of specialty drug savings delivered for VIVIO customers. Validation Institute independently certified a self-funded employer with 27,000 covered lives that spent 39% less in their first year with VIVIO than they did in the previous year with a Big-3 PBM.

The analysis compared an employer’s specialty drug costs in 2021 with a traditional PBM to that same employer’s specialty drug costs in 2022 managed by VIVIO.

This chart summarizes the Per Member Per Month (“PMPM”) costs for the employer before VIVIO and the following year with VIVIO. VIVIO’s PMPM costs were 39% lower than under the prior plan.

While PBM models focus on formularies that exclude drugs and limit drug access, VIVIO takes the opposite approach of personalizing drug therapies for each patient without formulary restrictions.

“As an independent, objective third-party organization, Validation Institute provides unbiased, data-driven insights on healthcare programs. The goal is to put more purchasing power into buyers’ hands,” said Benny DiCecca, Validation Institute CEO & President. “Our team found that the VIVIO program significantly reduces specialty drug costs.”

“We are delighted to have received independent third-party validation of the VIVIO program,” said Chris Crawford, VIVIO’s Chief Growth Officer. “We have taken a different approach than the traditional PBM model, which is proven to deliver better health outcomes for the members we serve and lower costs for our employer customers.”

About VIVIO

We prioritize health outcomes by fixing the following system problems: identifying expensive drug therapies that don’t work even though they have FDA approval; not knowing if a member is responding adequately to the therapy; doctors not reading the clinical trials themselves; the arbitrary line between pharmacy and medical benefit; and, egregious supply chain waste. VIVIO uses clinical trial, patient, and financial data to drive better health outcomes while eliminating wasted spending. VIVIO Precision Care™ plugs into an employer’s current carriers and PBMs. In 2021, VIVIO customers spent 67% less on specialty drugs than the national benchmark.

About Validation Institute

Validation Institute is a professional community that advocates for organizations and approaches that deliver better health value and stronger health outcomes at lower cost. We connect, train, and certify health care purchasers, and we validate and connect providers delivering superior results. Founded in 2014, the mission of the organization has consistently been to help provide transparency to buyers of health care. To learn more about Validation Institute, visit validationinstitute.com

Media contact:

T. J. Tedesco

[email protected]

For PDF of this news release, click here.

The benefit of any treatment for any disease should be judged by whether it improves either survival or its quality. For adjuvant treatment of cancer, effects on overall survival (OS) are paramount: Patients and their oncologists are willing to accept substantial toxicity and short-term deficits in quality of life, if long-term survival can be improved. Assessment of the validity of randomized controlled trials (RCTs) evaluating adjuvant therapy requires that several questions about trial design and analysis be addressed.Read the full article at: https://ascopubs.org/doi/full/10.1200/JCO.23.00280